Estate Planning, in its simplest form, is the manner in which your various holdings (including cash, real estate, investments and personal effects) are given to your loved ones during your lifetime and after your death.

Everyone has an estate plan by their own design or by the state's design if they so choose. People who die without formulating their own personal estate plan allow the state to decide who their beneficiaries will be, and how their various assets will be divided between these beneficiaries. This type of plan is called "intestate succession." It is the legislature's attempt to define those family members closest to you, and to whom it would be most logical to leave your inheritance. The order of preference is basically this: surviving spouse, lineal descendants, parents, brothers and sisters, grandparents, uncles and aunts, cousins, and then on to more remote relatives.

The problem with intestate succession is that it may exclude relatives you wish to include, and/or include beneficiaries you did not wish to partake of your wealth, such as family members who receive medical or governmental assistance, and for whom an inheritance might jeopardize such benefits.

Various Types Of Estate Plans

Last Will and Testament: This is the simplest and most common estate plan. In this document you not only name your beneficiaries, but you also name the person or entity to oversee and manage your assets during the probate period (the "Executor"), and who is to have custody and care of your minor children, if any (the "Guardian").

If you have special provisions to hold anyone's inheritance in trust for a period of years after your death, you would also name a Trustee to be in charge of managing that person's portion for the period of time you specify.

It is important to note that all wills are subject to the probate process. However, sometimes a will needn't actually be taken through the long, drawn out court hearings and petitions we know as "probate." That is because estates with a gross value of less than $150,000 are exempt from probate. Such small estates can be passed quickly and directly to the beneficiaries after the decedent's debts have all been paid, and if there are no contesting beneficiaries.

Joint Tenancy: This is a type of contract between all the named owners, where the surviving owners continue to hold title to the asset(s). The descendant’s portion is distributed to the surviving joint tenant(s) regardless of what the decedent's will says. A joint tenancy asset is not subject to the probate process at all; it always takes precedence over a will or intestate succession. This is true even if the joint tenants didn't know it or want this result at the time they created the joint tenancy.

For example, if: (I) a married couple each has children from prior marriages, (2) the family home is in joint tenancy with each other, (3) one spouse dies, and (4) the other (who now is technically and legally sole owner of the house) dies with a will stating, "Distribute all my property to my children," then the first spouse's children are disinherited.

Another problem is income tax-related. California has a community property system, which is quite beneficial to a surviving spouse who wants to sell the family home. If the home is in joint tenancy, the surviving spouse may experience some grave income tax consequences upon sale of the house, which wouldn't exist if the home were in community property. This is true for any other highly appreciated assets, as well. There are some exceptions to this rule, but these exceptions are for your personal residence only, and not investment properties or other types of appreciated assets.

Revocable Living Trust: This type of estate plan combines the good aspects of wills, such as specifically delineating your beneficiaries and the proper manner in which they are to receive their inheritance, while avoiding probate. A revocable living trust, in its simplest form, is a different way to own property ("property" includes all types of holdings, such as your home, investments, life insurance and, to a limited extent, retirement benefits, I.R.A.'s and personal effects). It is a contract between you, as property owner, and the Trustee, so long as you provide alternate beneficiaries to receive your assets after your death.

The trust is ''revocable," for you can change the beneficiaries just as with a will, and also the successor Trustees from time to time. You can also change the assets in the trust without incurring additional legal expense.

To illustrate, think of a trust as a box into which you pack all of your holdings. Everything in the box is under the care and control of the Trustee for as long as you desire (i.e.: for life). Upon your death, the Trustee is to unpack the box, and distribute the items to your beneficiaries in the manner you determine best. Anything not already in the box is subject to probate, if you have not made other arrangements. Therefore, when you set up a trust, it is important also to transfer your assets to your Trustee afterward. I will provide you the means to do so.

A trust avoids probate whenever all of decedent's assets have been transferred to the office of Trustee before the decedent dies, since it is the Trustee who holds title to the assets, even if you serve as your own Trustee.

There are several different types of trusts available to people, and they can and should be tailored to your specific needs and desires. Not all families have immediate need of federal estate tax protection provided by a trust, but all of us would like income tax protection for our beneficiaries. A properly prepared trust can also shift income so that taxes are significantly reduced or deferred.

Additionally, a trust can be set up to care for beneficiaries with special needs, such as for elderly or disabled persons receiving benefits or services, and for beneficiaries who are not yet in a position to handle money wisely.

INCLUDED IN A COMPLETE PLAN

Durable Powers of Attorney: There are two recognized durable powers of attorney in California. The first is used to name an individual to do the following: (1) transfer your assets into your trust for you, (2) amend your trust to conform to current law (but not to change your beneficiaries, unless you specifically allow it), and (3) file tax returns and other paperwork for you.

This type of power of attorney can be immediately effective, or it can be effective sometime in the future when you are deemed incapacitated and can no longer do these things for yourself. I prefer the latter type, since you retain as much control over your finances as you do now. In it, you can also specifically designate the individual(s) whom you authorize to determine whether you are incapacitated in the future.

Advance Health Directive: The second type is for health care decisions only. Here, you name someone whom you authorize to obtain medical help for you in the event you can no longer do so for yourself. This document discusses provision (and withdrawal) of medical services, medication and heroic measures to keep you alive, and is custom-tailored to your wishes. By state law, this document has only a seven-year life span and must be reviewed and renewed.

Nominations for Conservator: A conservator is a court-appointed person empowered to make financial decisions for you if you are incompetent. It is not automatically your spouse, but spouses are given preferential treatment by the courts. Most of the time when clients have powers of attorney and living trusts, they have no need of conservatorships, but this document is available for those times when a conservatorship is necessary.

Directives to Physicians: The health care directive also contains a section in which you state that it either is, or is not, your desire to have your life artificially prolonged if two physicians determine that you have suffered "brain death" due to an incurable illness, injury or old age.

Pour-Over Will: If you were to pass away prior to transferring all of your assets into your trust, anything outside the trust may go through the probate process. Also, if someone wills something to you, but you die before his/her estate closes, the bequest to you would be paid to your estate, unless the decedent had named an alternate beneficiary. In either case, this will "pours over" into your trust anything, which would be part of your probate estate. You must be aware, however, that anything passing under the pour-over will must go through probate! Things already in the trust still have no need to be probated, however.

Cost of Estate Planning

Each trust is customized to individual needs and desires, so it's difficult to pinpoint actual costs prior to your first consultation. Fees are based on which plan you choose. You will receive an accurate quotation after our first meeting.

*** If You Own A House, You Need A Trust! ***

You don't have to be rich to have an estate, or to plan one. In fact, most people have valuable estates ... even if they don't live in mansions; because an estate is the sum total of everything you own – your home, possessions and savings. It’s the years of hard work you want to pass on to your children and loved ones as an inheritance.

Most people have a Will to protect their estate and family. But for many, a Will isn't enough! Generally, Wills must be probated, a short legal term for a long and expensive legal procedure when the value of your assets is in excess of $150,000.

Almost every Will must be probated in order to pass on assets to beneficiaries.

Luckily, a good estate plan avoids these complications by setting up a "Living Trust."

A Living Trust allows you to pass on assets to your spouse, children and others, immediately and without delay. It avoids the lawyers, administrators, courts and appraisers that can tie up your assets for months or even years.

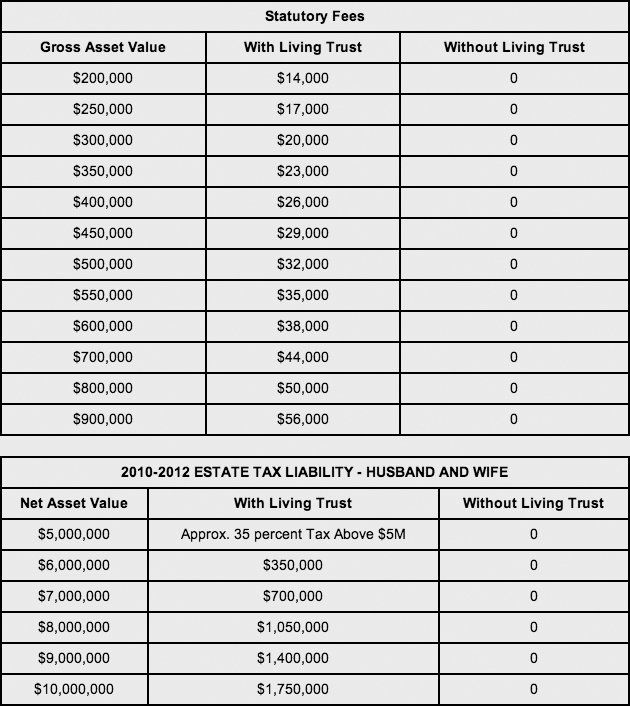

Best of all, estate plans keep lawyers and administrators from "inheriting" a good chunk of your estate through probate. For example, a Living Trust saves $14,000 in legal fees (this includes attorney's fees and executor's/administrator's Statutory commissions) and costs necessary to probate a $200,000 estate in California. If a husband and wife have a $6,000,000 estate, a Living Trust saves $350,000 or more in inheritance taxes.

How can you tell if you need an estate plan? I will explain your options in plain, simple English, and give you a written estimate of the fees involved in planning your estate.

So even if you don't live on an estate, you can plan one with an attorney.